I’m about to buy and sell Australian shares for the first time (I inherited a lot).

Sell AMP, BKI, VUK & possibly others.

Any recommendations for shares to buy – for long term (eg. 10 year) gain?

I’m about to buy and sell Australian shares for the first time (I inherited a lot).

Sell AMP, BKI, VUK & possibly others.

Any recommendations for shares to buy – for long term (eg. 10 year) gain?

mollwollfumble said:

I’m about to buy and sell Australian shares for the first time (I inherited a lot).

Sell AMP, BKI, VUK & possibly others.Any recommendations for shares to buy – for long term (eg. 10 year) gain?

Evening Moll, I would suggest you talk to a broker

kryten said:

mollwollfumble said:

I’m about to buy and sell Australian shares for the first time (I inherited a lot).

Sell AMP, BKI, VUK & possibly others.Any recommendations for shares to buy – for long term (eg. 10 year) gain?

Evening Moll, I would suggest you talk to a broker

Something which none of us are.

mollwollfumble said:

I’m about to buy and sell Australian shares for the first time (I inherited a lot).

Sell AMP, BKI, VUK & possibly others.Any recommendations for shares to buy – for long term (eg. 10 year) gain?

I’d offer you some advice, but my crystal ball has just gone in for its 5000 prediction service.

kryten said:

mollwollfumble said:

I’m about to buy and sell Australian shares for the first time (I inherited a lot).

Sell AMP, BKI, VUK & possibly others.Any recommendations for shares to buy – for long term (eg. 10 year) gain?

Evening Moll, I would suggest you talk to a broker

AMP are junk shares.

Everyone thought, initially, that they were going to be the next BHP, because, hey, it’s AMP, they’re going to be the next big bank, right?

And AMP did so desperately want to be a bank, and they had a couple of goes at it in a back-alley get-rich-quick kind of way which backfired every time, and then they got plundered by their executives, and they couldn’t control the skimming scams that their brokers had going , and, basically, what was once a revered name in Australian business is now less than ‘mud’.

I’m surprised that they still survive. They must be selling the family silver to keep themselves afloat.

captain_spalding said:

kryten said:

mollwollfumble said:

I’m about to buy and sell Australian shares for the first time (I inherited a lot).

Sell AMP, BKI, VUK & possibly others.Any recommendations for shares to buy – for long term (eg. 10 year) gain?

Evening Moll, I would suggest you talk to a broker

AMP are junk shares.

Everyone thought, initially, that they were going to be the next BHP, because, hey, it’s AMP, they’re going to be the next big bank, right?

And AMP did so desperately want to be a bank, and they had a couple of goes at it in a back-alley get-rich-quick kind of way which backfired every time, and then they got plundered by their executives, and they couldn’t control the skimming scams that their brokers had going , and, basically, what was once a revered name in Australian business is now less than ‘mud’.

I’m surprised that they still survive. They must be selling the family silver to keep themselves afloat.

Yep, I invested $6000 into AMP shares in the mid 90’s because it was a “blue chip” stock. Big finance company, expanding, and a safe, long term investment. After nearly 30 years of Safe long term growth, those shares are now worth $156.

Kingy said:

captain_spalding said:

kryten said:Evening Moll, I would suggest you talk to a broker

AMP are junk shares.

Everyone thought, initially, that they were going to be the next BHP, because, hey, it’s AMP, they’re going to be the next big bank, right?

And AMP did so desperately want to be a bank, and they had a couple of goes at it in a back-alley get-rich-quick kind of way which backfired every time, and then they got plundered by their executives, and they couldn’t control the skimming scams that their brokers had going , and, basically, what was once a revered name in Australian business is now less than ‘mud’.

I’m surprised that they still survive. They must be selling the family silver to keep themselves afloat.

Yep, I invested $6000 into AMP shares in the mid 90’s because it was a “blue chip” stock. Big finance company, expanding, and a safe, long term investment. After nearly 30 years of Safe long term growth, those shares are now worth $156.

My superannuation was originally with National Mutual, bought out by a French company, then bought out by AMP. Because I’d been in it so long I stuck it out almost to the end, but rolled it over into our self managed fund about 18 months early in 2017 when things really looked like AMP was going bad. I didn’t want to lose the lot. It didn’t cost much that way, about $800 lost. Worth it to be out of there.

buffy said:

Kingy said:

captain_spalding said:AMP are junk shares.

Everyone thought, initially, that they were going to be the next BHP, because, hey, it’s AMP, they’re going to be the next big bank, right?

And AMP did so desperately want to be a bank, and they had a couple of goes at it in a back-alley get-rich-quick kind of way which backfired every time, and then they got plundered by their executives, and they couldn’t control the skimming scams that their brokers had going , and, basically, what was once a revered name in Australian business is now less than ‘mud’.

I’m surprised that they still survive. They must be selling the family silver to keep themselves afloat.

Yep, I invested $6000 into AMP shares in the mid 90’s because it was a “blue chip” stock. Big finance company, expanding, and a safe, long term investment. After nearly 30 years of Safe long term growth, those shares are now worth $156.

My superannuation was originally with National Mutual, bought out by a French company, then bought out by AMP. Because I’d been in it so long I stuck it out almost to the end, but rolled it over into our self managed fund about 18 months early in 2017 when things really looked like AMP was going bad. I didn’t want to lose the lot. It didn’t cost much that way, about $800 lost. Worth it to be out of there.

That’s also exactly why I had bugger all super.

buffy said:

My superannuation was originally with National Mutual, bought out by a French company, then bought out by AMP. Because I’d been in it so long I stuck it out almost to the end, but rolled it over into our self managed fund about 18 months early in 2017 when things really looked like AMP was going bad. I didn’t want to lose the lot. It didn’t cost much that way, about $800 lost. Worth it to be out of there.

My uncle (now deceased) worked for AMP in the 1960s. Also played rugby union for their corporate team.

He said, of the demutualised and reprehensible beast that AMP had become, that the directors of old, as self-serving as they were, would be spinning in their graves at what had happened to the society.

captain_spalding said:

buffy said:My superannuation was originally with National Mutual, bought out by a French company, then bought out by AMP. Because I’d been in it so long I stuck it out almost to the end, but rolled it over into our self managed fund about 18 months early in 2017 when things really looked like AMP was going bad. I didn’t want to lose the lot. It didn’t cost much that way, about $800 lost. Worth it to be out of there.

My uncle (now deceased) worked for AMP in the 1960s. Also played rugby union for their corporate team.

He said, of the demutualised and reprehensible beast that AMP had become, that the directors of old, as self-serving as they were, would be spinning in their graves at what had happened to the society.

The rep who set up my super was very good. He made sure that it stated that I would be paid if I couldn’t “work as an optometrist”. My income insurance had a similar clause. You can’t get that sort of thing now.

Kingy said:

captain_spalding said:

kryten said:Evening Moll, I would suggest you talk to a broker

AMP are junk shares.

Everyone thought, initially, that they were going to be the next BHP, because, hey, it’s AMP, they’re going to be the next big bank, right?

And AMP did so desperately want to be a bank, and they had a couple of goes at it in a back-alley get-rich-quick kind of way which backfired every time, and then they got plundered by their executives, and they couldn’t control the skimming scams that their brokers had going , and, basically, what was once a revered name in Australian business is now less than ‘mud’.

I’m surprised that they still survive. They must be selling the family silver to keep themselves afloat.

Yep, I invested $6000 into AMP shares in the mid 90’s because it was a “blue chip” stock. Big finance company, expanding, and a safe, long term investment. After nearly 30 years of Safe long term growth, those shares are now worth $156.

Hodling isn’t usually a good strategy.

If you don’t know more than the market buy an index fund or similar and mind the CGT…

buffy said:

captain_spalding said:

buffy said:My superannuation was originally with National Mutual, bought out by a French company, then bought out by AMP. Because I’d been in it so long I stuck it out almost to the end, but rolled it over into our self managed fund about 18 months early in 2017 when things really looked like AMP was going bad. I didn’t want to lose the lot. It didn’t cost much that way, about $800 lost. Worth it to be out of there.

My uncle (now deceased) worked for AMP in the 1960s. Also played rugby union for their corporate team.

He said, of the demutualised and reprehensible beast that AMP had become, that the directors of old, as self-serving as they were, would be spinning in their graves at what had happened to the society.

The rep who set up my super was very good. He made sure that it stated that I would be paid if I couldn’t “work as an optometrist”. My income insurance had a similar clause. You can’t get that sort of thing now.

Yes you can. In the case of insurance anyway.

poikilotherm said:

buffy said:

captain_spalding said:My uncle (now deceased) worked for AMP in the 1960s. Also played rugby union for their corporate team.

He said, of the demutualised and reprehensible beast that AMP had become, that the directors of old, as self-serving as they were, would be spinning in their graves at what had happened to the society.

The rep who set up my super was very good. He made sure that it stated that I would be paid if I couldn’t “work as an optometrist”. My income insurance had a similar clause. You can’t get that sort of thing now.

Yes you can. In the case of insurance anyway.

I must be mistaken. I was pretty sure that when I looked into taking out different income insurance it was not possible.

kryten said:

mollwollfumble said:

I’m about to buy and sell Australian shares for the first time (I inherited a lot).

Sell AMP, BKI, VUK & possibly others.Any recommendations for shares to buy – for long term (eg. 10 year) gain?

Evening Moll, I would suggest you talk to a broker

But don’t let him sway you into something you were not expecting. One of my sister’s friends walked out one day heavily invested in Gunns.

I like the idea of investing in stuff you are interested in.

buffy said:

poikilotherm said:

buffy said:The rep who set up my super was very good. He made sure that it stated that I would be paid if I couldn’t “work as an optometrist”. My income insurance had a similar clause. You can’t get that sort of thing now.

Yes you can. In the case of insurance anyway.

I must be mistaken. I was pretty sure that when I looked into taking out different income insurance it was not possible.

Yea, it can still be done, each fund is different these days and some don’t offer it but it can be bought outside the fund.

Do you know of a good renewable energy firm to invest in. Not the Cooper Basin hot rock project which collapsed. Australia’s wind turbines have recently been sold off overseas. Snowy Hydro shares aren’t for sale. I don’t know any other good ones.

As for mining, the iron ore exports to China recently collapsed and Aluminium being a big electricity user is at a disadvantage when coal is being phased out. Oil and gas is not a great prospect in a future run by renewables.

> Speak to a stock broker.

Boy are you behind the times. There haven’t been any stock brokers in Australia for the past five years or so.

“Investment advisers” don’t actually know anything about shares. Only about balanced packages, superannuation.

I used to think that AMP could never go bottom up because they owned half of the big buildings in Sydney.

They’ve been selling off the more profitable parts of the company lately to interested buyers. It takes time to dismantle such a large firm.

I thought I might try a big Australian food company but there aren’t any.

Investigate exchange-traded funds.

Why are you only looking at 100% Australian companies?

The trouble with trading individual shares is that a single company running into trouble can make a huge dent in your investment, so my advice on share trading would be, don’t, or if you do, make sure you have a lot of different companies in different markets.

If you invest in some funds somebody else will look after the diversification, and the risk is reduced, although not to zero.

I started investing in managed funds through a company that didn’t provide any “advice”, and didn’t charge an exorbitant fee for it. They were taken over several times, and are now run by BT, but still provide the “no advice” service, although I don’t know if they do that for new customers. Average earnings over 20 years have been about 10% after all costs, which seems reasonable, much better than cash anyway.

The Rev Dodgson said:

Why are you only looking at 100% Australian companies?The trouble with trading individual shares is that a single company running into trouble can make a huge dent in your investment, so my advice on share trading would be, don’t, or if you do, make sure you have a lot of different companies in different markets.

If you invest in some funds somebody else will look after the diversification, and the risk is reduced, although not to zero.

I started investing in managed funds through a company that didn’t provide any “advice”, and didn’t charge an exorbitant fee for it. They were taken over several times, and are now run by BT, but still provide the “no advice” service, although I don’t know if they do that for new customers. Average earnings over 20 years have been about 10% after all costs, which seems reasonable, much better than cash anyway.

Ta. I had an investment in BT back in the late 1980s. I lost every cent of it. After that happened twice, I lost faith in managed funds.

These days, the risk is not reduced. Shares, on the scale of months, move in lock-step because the price goes up when people have money and goes down when people need money. Just count how many shares halved in value in early 2020, about half of them. Looking at shares then, I said to myself “shares are a really bad investment because everything I own has lost value”, which shows my stupidity, I should have said “yippee, this is a really great time to buy”. :-(

If I had the patience, which I don’t, the best investment option would be to keep a stock portfolio that exactly matches that of a very good fund manager. But they trade shares at least once a week.

As for buying Australian shares only. Two reasons. One is I know Australian companies better, the other is that I want to support local businesses.

I can’t buy shares in either ALDI or Snowy Hydro. But it looks like both may be issuing shares on the Australian stock market in the next few years.

—

I’ve sort of settled on:

Endeavour (which owns BWS and Dan Murphys)

NAB (typical bank)

Santos (a risk here, natural gas)

Woolworths

Westfarmers (which owns Officeworks, Bunnings and KMart)

Scentre (Westfield shopping centre)

AGL (into solar power as well these days)

BHP

Transurban (let’s hope the building boom continues)

and tentatively

Rio Tinto (the biggest aluminium)

CSR (building products)

If I dared, I’d support CSL, formerly Commonwealth Serum Laboratories, the most scientific of all. But I don’t dare.

mollwollfumble said:

The Rev Dodgson said:

Why are you only looking at 100% Australian companies?The trouble with trading individual shares is that a single company running into trouble can make a huge dent in your investment, so my advice on share trading would be, don’t, or if you do, make sure you have a lot of different companies in different markets.

If you invest in some funds somebody else will look after the diversification, and the risk is reduced, although not to zero.

I started investing in managed funds through a company that didn’t provide any “advice”, and didn’t charge an exorbitant fee for it. They were taken over several times, and are now run by BT, but still provide the “no advice” service, although I don’t know if they do that for new customers. Average earnings over 20 years have been about 10% after all costs, which seems reasonable, much better than cash anyway.

Ta. I had an investment in BT back in the late 1980s. I lost every cent of it. After that happened twice, I lost faith in managed funds.

These days, the risk is not reduced. Shares, on the scale of months, move in lock-step because the price goes up when people have money and goes down when people need money. Just count how many shares halved in value in early 2020, about half of them. Looking at shares then, I said to myself “shares are a really bad investment because everything I own has lost value”, which shows my stupidity, I should have said “yippee, this is a really great time to buy”. :-(

If I had the patience, which I don’t, the best investment option would be to keep a stock portfolio that exactly matches that of a very good fund manager. But they trade shares at least once a week.

As for buying Australian shares only. Two reasons. One is I know Australian companies better, the other is that I want to support local businesses.

I can’t buy shares in either ALDI or Snowy Hydro. But it looks like both may be issuing shares on the Australian stock market in the next few years.

—

I’ve sort of settled on:

Endeavour (which owns BWS and Dan Murphys)

NAB (typical bank)

Santos (a risk here, natural gas)

Woolworths

Westfarmers (which owns Officeworks, Bunnings and KMart)

Scentre (Westfield shopping centre)

AGL (into solar power as well these days)

BHP

Transurban (let’s hope the building boom continues)and tentatively

Rio Tinto (the biggest aluminium)

CSR (building products)If I dared, I’d support CSL, formerly Commonwealth Serum Laboratories, the most scientific of all. But I don’t dare.

So you haven’t considered ethical investmets per se?

roughbarked said:

So you haven’t considered ethical investments per se?

Well that’s just it. I haven’t found any.

I was hoping that you could recommend some.

captain_spalding said:

kryten said:

mollwollfumble said:

I’m about to buy and sell Australian shares for the first time (I inherited a lot).

Sell AMP, BKI, VUK & possibly others.Any recommendations for shares to buy – for long term (eg. 10 year) gain?

Evening Moll, I would suggest you talk to a broker

AMP are junk shares.

Everyone thought, initially, that they were going to be the next BHP, because, hey, it’s AMP, they’re going to be the next big bank, right?

And AMP did so desperately want to be a bank, and they had a couple of goes at it in a back-alley get-rich-quick kind of way which backfired every time, and then they got plundered by their executives, and they couldn’t control the skimming scams that their brokers had going , and, basically, what was once a revered name in Australian business is now less than ‘mud’.

I’m surprised that they still survive. They must be selling the family silver to keep themselves afloat.

They got the wrist slapped a lot as a consequence for the finding of the financial institutions enquiry , thing , for example , charging customer for an insurance that provided essentially no true benefit amongst other things

mollwollfumble said:

roughbarked said:

So you haven’t considered ethical investments per se?

Well that’s just it. I haven’t found any.

I was hoping that you could recommend some.

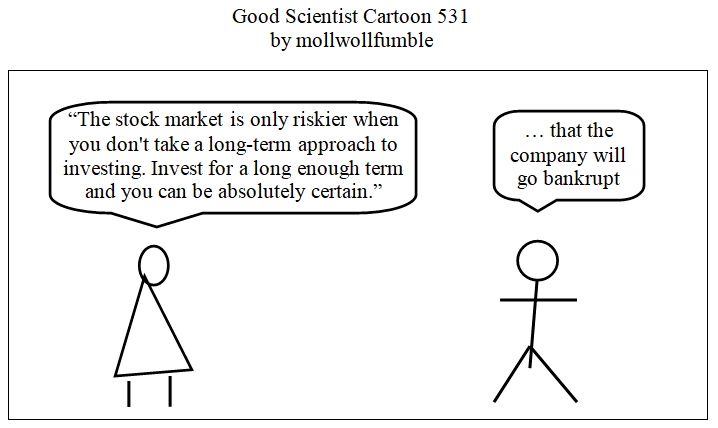

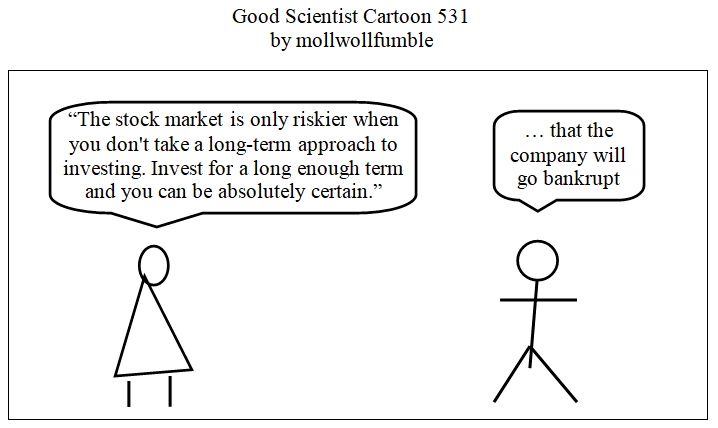

To paraphrase Gandhi:

‘What do you think of ethical investments?’

‘I think it would be wonderful if they existed.’