My son (SW Sydney) has had his account cleaned out. Commbank.

He’s been into branch and they said it happened in Victoria.

Long story short, they say investigation can take 40 days.

I’m waiting for his physical presence to get more info.

1. How does this happen?

2. Is it normal for a bank to take so long to return your money when it’s obvious you were not in another state yesterday?

Hey, Mr. Car,

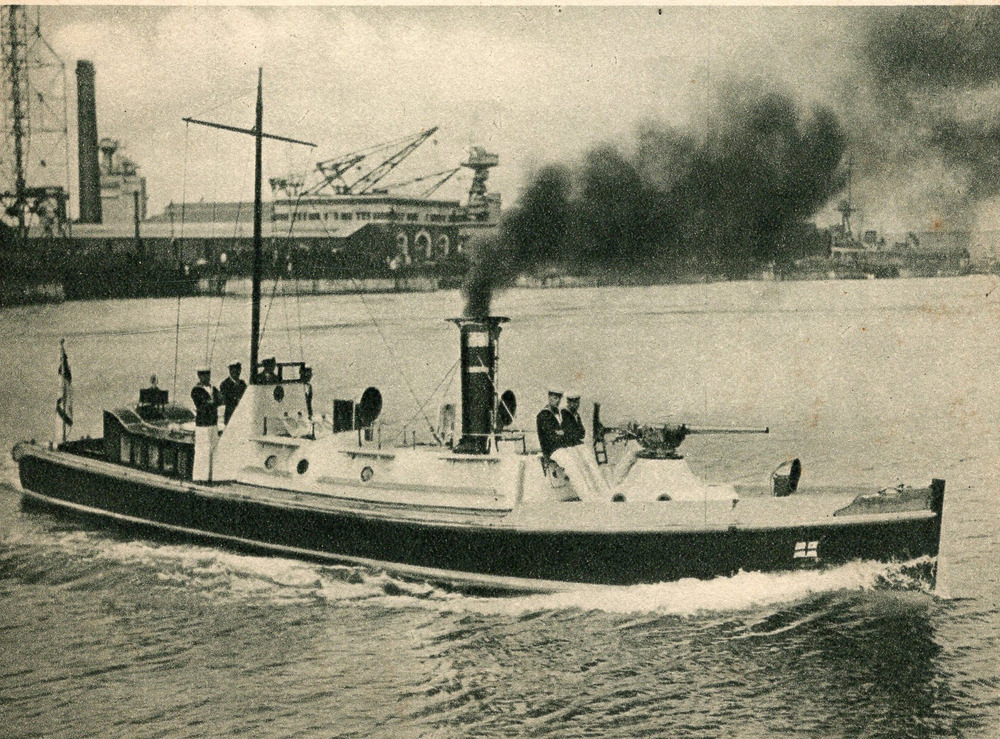

Here’s a pic of a 50 ft steam pinnace:

It’s from one of those ‘boy’s books’ of bygone eras, probably 1920s, this one about the Navy, which i have in my bookselves.

It’s a 50 ft steam pinnace, which has the flag of a full Admiral on the bow.

As you can see, it has a 3 lb ‘quick-firing’ gun on the bow for picket duties.

The boat’s crew are wearing a uniform of black serge jumpers and white duck trousers, no doubt to give that touch of distinction to the crew of the Admiral’s barge. You can get away with stuff like that when you’re an Admiral.